colorado springs sales tax online

View this and more full-time part-time jobs in Colorado Springs CO on Snagajob. 15 or less per month.

Big Changes Brewing At One Of The West S Best Resorts The Broadmoor In Colorado Springs

Sales Tax Filing and Payment Portal.

. You can print a 82. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs. Annual returns are due January 20.

Recent Colorado statutory changes require retailers to charge collect and remit a new fee. Apply for a HR Block Inc. Sales Use Tax System SUTS State-administered and home rule sales and use tax filing.

After you create your own User ID and Password for the income tax account you may file a return. City of Colorado Springs Department 2408 Denver CO 80256-0001 Online Services instructions additional forms amended returns are available on our website. Please consult your local tax authority for specific details.

The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Colorado Springs. In Colorado services are not subject to sales tax. Most Colorado sales tax license types are valid for a two-year period and expire at the end of each odd-numbered year.

If you filed online or with a tax software and want to pay by check or money order. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail. The average cumulative sales tax rate in Colorado Springs Colorado is 781 with a range that spans from 513 to 863.

Sales tax returns may be filed annually. Filing frequency is determined by the amount of sales tax collected monthly. Welcome to the City of Colorado Springs.

Living in Colorado Springs. Your browser appears to have cookies disabled. Payment After Filing Online.

Make the check or money order payable to the Colorado Department of Revenue. The December 2020 total local sales tax rate was 8250. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax.

This includes the rates on the state county city and special levels. Accelerated Tax Associate job in Colorado Springs CO. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county.

The current total local sales tax rate in Colorado Springs CO is 8200. There are a few ways to e-file sales tax returns. Cookies are required to use this site.

File Sales Tax Online. Sales Tax Rates in the City of Glenwood Springs.

Colorado Springs Housing Market Prices Forecast 2022

Sales Tax Reports Colorado Springs

Colorado Springs Chamber Edc Home Facebook

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Used Car Dealer In Colorado Springs Co 80909 Drivetime

Call Center Set Up In Colorado For Tabor Refund Checks 55 Of Checks Mailed Out Have Been Cashed As Of Aug 17

How Do I Register For A Colorado Sales Tax License When Starting A New Fitness Business

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Information Colorado Springs

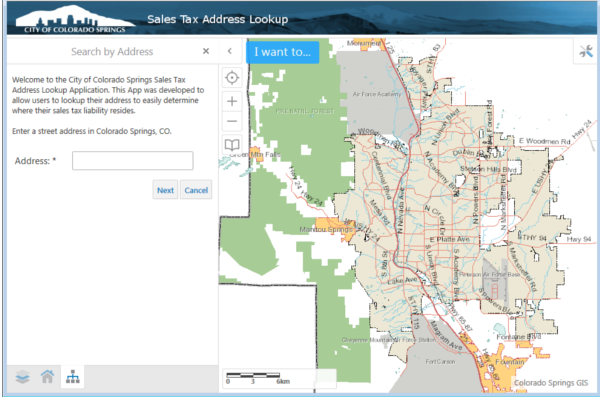

Sales Tax Address Lookup Application Colorado Springs

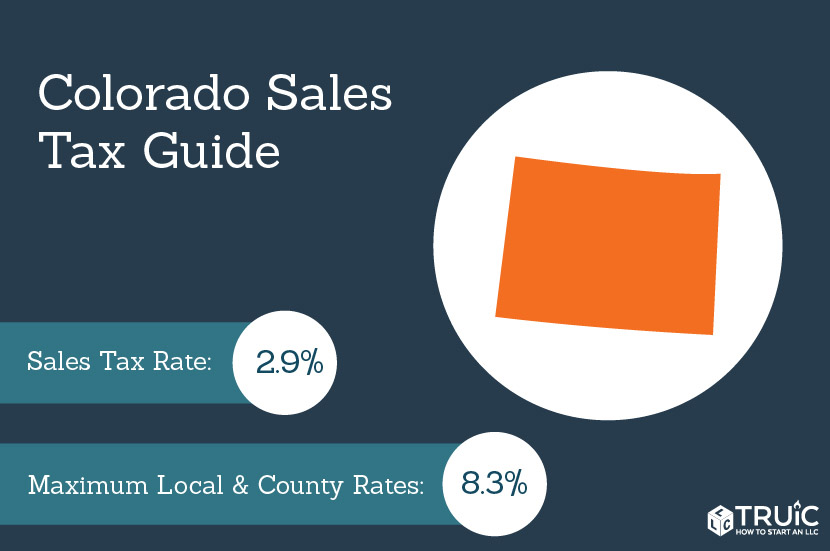

Colorado Sales Tax Small Business Guide Truic

Marijuana Dispensary Near Me In Manitou Springs Maggie S Farm

Colorado Springs Sales Tax Collections Continue Their Strong Streak In September Subscriber Content Gazette Com

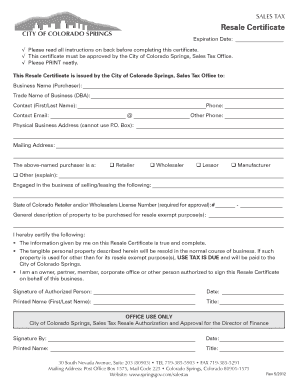

Colorado Resale Certificate Fill Online Printable Fillable Blank Pdffiller